Initial Details of Third Party Mobile Banking Unveiled

by GadgetGizmodo

By Aamir Attaa · Sunday, Apr 10, 2011 2 Comments

We first heard of Third Party Solution for Mobile Banking in November 2009, when Pakistan Telecommunication Authority and State Bank of Pakistan jointly announced the proposed formation of unified regulatory framework for Third Party Solution Provider (TPSP) system for enhancing mobile banking in the country.

During the while, there went various meetings, conferences and announcements regarding the upcoming system. Latest of these was a news that surfaced just last month when Dr. Yaseen, Chairman PTA announced that regulation for Third Party Solution for Mobile Banking will be finalized by year end.

In his recent post on personal blog, Dr. Yaseen has unveiled various details of this third party solution, according to which, a proposition is being reached where all cellular companies will be able to offering mobile banking services to their customers, regardless of the bank these customers have account with.

Meaning that, it won’t be hard for customers to manage their Citi bank accounts (or account in any other bank) with their Ufone connections. And even if they opt for Mobile Number Portability and move to Telenor (or any other network), their Citi Bank account will still be managed by mobile phone, smoothly.

Dr. Yaseen explains this in following words:

Consumers belonging to any bank and mobile operator would have the freedom of managing their finances when and where they want.

This means that all banks and mobile operators would be able to connect with each other resulting in a situation where any bank customer can access their accounts, transfer funds, and interact with all other bank customer using mobile connection.

This system is named as Mobile Payment Service Providers or MPSP.

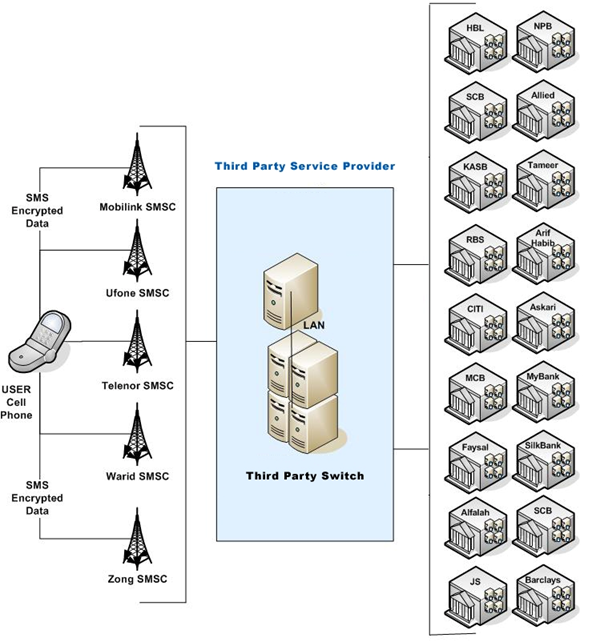

Check below image for further elaboration:

Block Diagram of the TPS Model

Security is going to remain the primary concern for the regulators. But that would easily be managed by having multiple layered security checks through encrypted SMS channels.

We are yet to hear more details on the system, to get a clearer picture. But for now, we can see this system very useful for the end user, creating more opportunities for both the cellular companies and the banks. At the same time, customer will be more enabled after this with 24/7 access to their bank account from mobile phones.

I am sure this system will be warmly welcomed by all the banks and cellular companies, except of those who have already invested millions of rupees in getting their mobile commerce solutions.

Telenor for instance, has heavily invested (both the money and time) to get its Easypaisa streamlined. They have successfully transacted over Rs. 20 billion with 9.9 million transactions till December 2010.

UBL omni is another notable product, which has gained popularity over the time.

In other words, there might be a slight chance of conflict of interest for both the operators and banks. But again, let’s wait for more details to come in to have a clearer outcome of this proposed third party solution for mobile banking services.

Related Stories- Pakistan to Get Third Party Mobile Banking Regulations this Year

- Banking for the Unbanked â€" Mobile Banking Steps up!

- Mobile Banks â€" Next in Line Industry

- Ufone Enhances its Mobile Banking Solution Called UPayments

- PTA’s new Decision to Promote Mobile Banking

- Ufone join hands with HBL for Mobile Commerce Solutions

Tags: Banking, Mobile Banking, Mobile commerce, Mobile Users, Pakistan, PTA, regulations, State Bank, Telecom, Third Party Mobile Banking

Powered By WizardRSS.com | Full Text Feed | Amazon Affiliate

0 comments:

Leave a Comment